Big Debt Crisis - 4

In many cases, monetary policy helps inflate the bubble rather than constrain it. This is especially true when inflation and growth are both good and investment returns are great. Such periods are typically interpreted to be a productivity boom that reinforces investor optimism as they leverage up to buy investment assets. In such cases, central banks, focusing on inflation and growth, are often reluctant to adequately tighten money. This is what happened in Japan in the late 1980s, and in much of the world in the late 1920s and mid-2000s. This is one of the biggest problems with most central bank policies—i.e., because central bankers target either inflation or inflation and growth and don’t target the management of bubbles, the debt growth that they enable can go to finance the creation of bubbles if inflation and real growth don’t appear to be too strong. In my opinion it’s very important for central banks to target debt growth with an eye toward keeping it at a sustainable level — i.e., at a level where the growth in income is likely to be large enough to service the debts regardless of what credit is used to buy. Central bankers sometimes say that it is too hard to spot bubbles and that it’s not their role to assess and control them—that it is their job to control inflation and growth. But what they control is money and credit, and when that money and credit goes into debts that can’t be paid back, that has huge implications for growth and inflation down the road. The greatest depressions occur when bubbles burst, and if the central banks that are producing the debts that are inflating them won’t control them, then who will? The economic pain of allowing a large bubble to inflate and then burst is so high that it is imprudent for policy makers to ignore them, and I hope their perspective will change.

大部分央行的目标是控制通胀或者通胀就增长。但没有明确说要控制债务水平。Ray觉得既然央行是money和credit的创造者,那自然就有义务控制债务水平,太高的债务水平导致不能偿还会有很大的可能性影响增长和通胀。

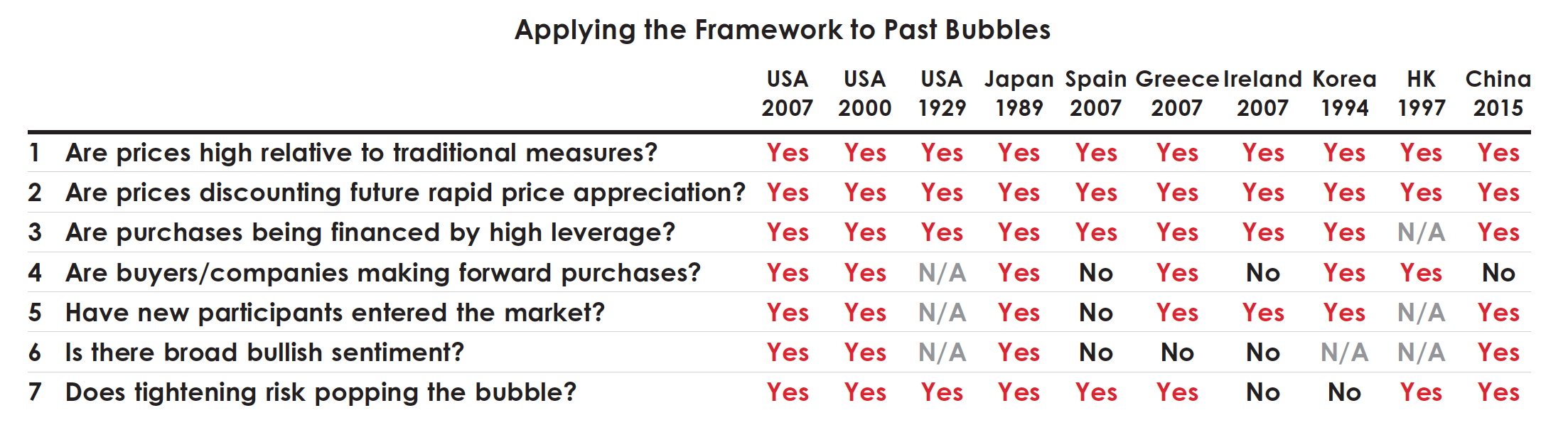

To identify a big debt crisis before it occurs, I look at all the big markets and see which, if any, are in bubbles. Then I look at what’s connected to them that would be affected when they pop. While I won’t go into exactly how it works here, the most defining characteristics of bubbles that can be measured are: 1) Prices are high relative to traditional measures 2) Prices are discounting future rapid price appreciation from these high levels 3) There is broad bullish sentiment 4) Purchases are being financed by high leverage 5) Buyers have made exceptionally extended forward purchases (e.g., built inventory, contracted for supplies, etc.) to speculate or to protect themselves against future price gains 6) New buyers (i.e., those who weren’t previously in the market) have entered the market 7) Stimulative monetary policy threatens to inflate the bubble even more (and tight policy to cause its popping)

这里Ray给了一个定性的表格,从7个维度衡量泡沫,估计桥水内部会有一个更精确的模型吧。