Big Debt Crisis - 5

Typically, in the early stages of the top, the rise in short rates narrows or eliminates the spread with long rates (i.e., the extra interest rate earned for lending long term rather than short term), lessening the incentive to lend relative to the incentive to hold cash. As a result of the yield curve being flat or inverted (i.e., long-term interest rates are at their lowest relative to short-term interest rates), people are incentivized to move to cash just before the bubble pops, slowing credit growth and causing the previously described dynamic. Unemployment is normally at cyclical lows and inflation rates are rising. The increase in short-term interest rates makes holding cash more attractive, and it raises the interest rate used to discount the future cash flows of assets, weakening riskier asset prices and slowing lending. It also makes items bought on credit de facto more expensive, slowing demand. Short rates typically peak just a few months before the top in the stock market.

yeild curve 倒挂,短期利率达峰是会在股市到顶点的几个月前。

With investors unwilling to continue lending and borrowers scrambling to find cash to cover their debt payments, liquidity—i.e., the ability to sell investments for money—becomes a major concern. As an illustration, when you own a $100,000 debt instrument, you presume that you will be able to exchange it for $100,000 in cash and, in turn, exchange the cash for $100,000 worth of goods and services. However since the ratio of financial assets to money is high, when a large number of people rush to convert their financial assets into money and buy goods and services in bad times, the central bank either has to provide the liquidity that’s needed by printing more money or allow a lot of defaults. As this implies, a big part of the deleveraging process is people discovering that much of what they thought of as their wealth was merely people’s promises to give them money. Now that those promises aren’t being kept, that wealth no longer exists.

解释了萧条期为什么要印钱(inflationary)或者债务违约(deflationary)。人们觉得拥有的债券或者股权,在萧条期无法换成钱(来换成商品或者服务),因为市场上流动性不足,人们觉得是自己的钱,其实只不过是别人的承诺,是完全有可能违约的。

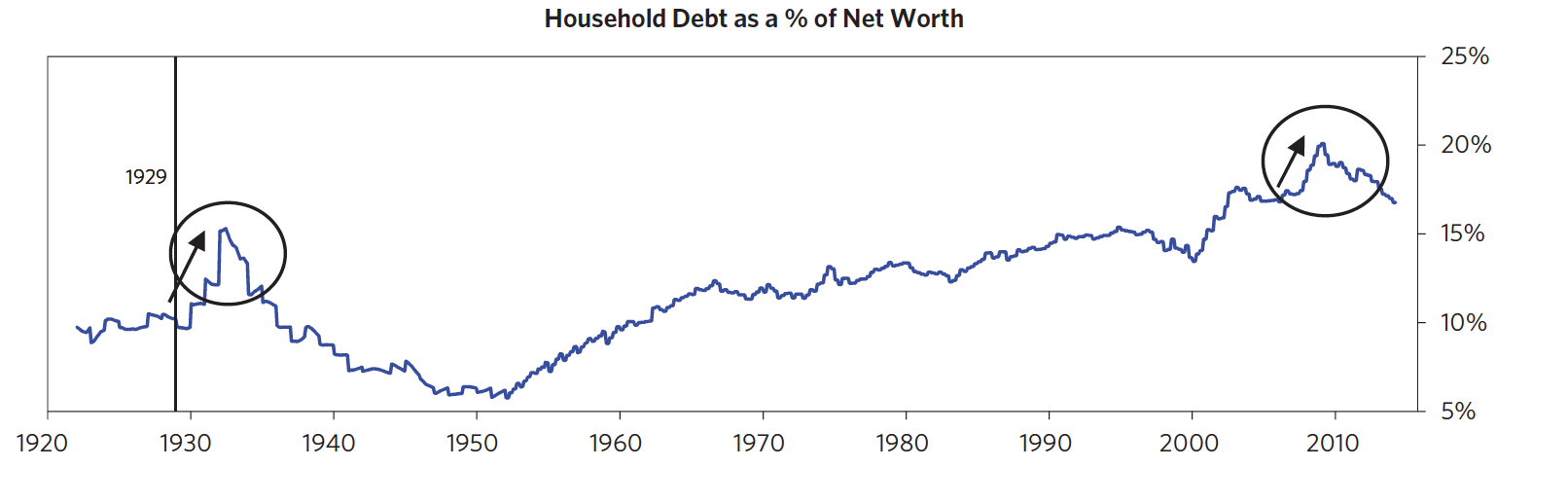

Since borrowers’ creditworthiness is judged by both a) the values of their assets/collaterals in relation to their debts (i.e., their net worth) and b) the sizes of their incomes relative to the sizes of their debt-service payments, and since both their net worth and their income fall faster than their debts, borrowers become less creditworthy and lenders more reluctant to lend. Even as debts are written down, debt burdens rise as spending and incomes fall. Debt levels also rise relative to net worth, as shown in the chart below. As debt-to-income and debt-to-net-worth ratios go up and the availability of credit goes down, naturally the credit contraction becomes self-reinforcing on the downside.

即使一些债务重组或者违约了,还是不能让借款者借到钱,因为债务负担减少的速度比收入和资产减少的速度要慢。