Big Debt Crisis - 6

There are two main ways in which failed lenders’ assets or existing lenders’ bad assets are managed: They are either a) transferred to a separate entity (an AMC) to manage the restructuring and asset disposal (about 40 percent of the cases studied) or b) they remain on the balance sheet of the original lending institution to manage (about 60 percent of cases). And there are several main levers for disposing of the nonperforming loans: a) restruc turing (e.g., working out the loans through extended terms), b) debt-for-equity swaps and asset seizures, c) direct sales of the loans or assets to third parties, and d) securitizations.

这儿介绍了对于lender来说集中处理债务危机的方式。

For systemically important borrowers or strategically important ones, policy makers generally take steps to ensure that the businesses remain intact as entities. In general this occurs through a restructuring of the debts to make the ongoing debt service manageable. This can occur through debt-for-equity swaps, through reducing the existing debts, lowering interest rates, or terming out the borrowing. Occasionally policy makers also introduce new lending programs to these borrowers to ensure their ongoing liquidity. This process is often explicitly one of the goals of AMCs set up to manage bad debts

对于系统性或者策略性上重要的借款人来说,policy maker也会在必要的时候帮助处理一些债务的问题。

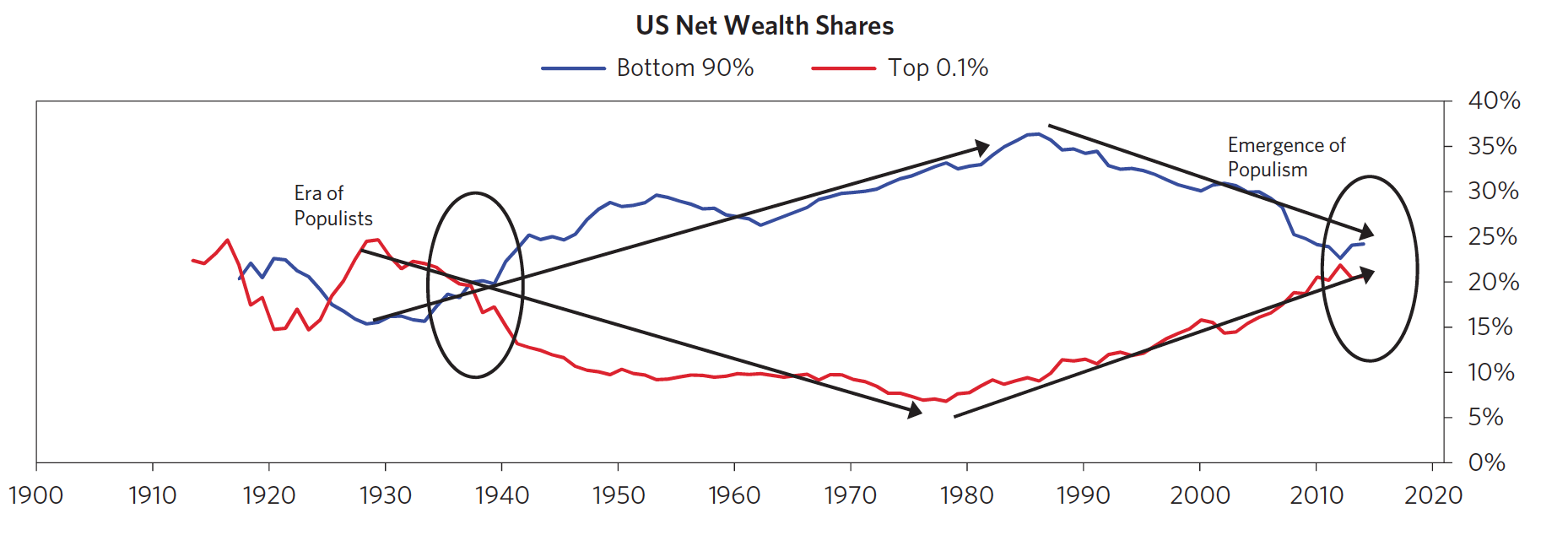

As shown below, both inequality and populism are on the rise in the US today, much as they were in the 1930s. In both cases, the net worth of the top 0.1 percent of the population equaled approximately that of the bottom 90 percent combined. Typically, increased taxation takes the form of greater income, property, and consumption taxes because these forms of taxation are the most effective at raising revenues. Wealth and inheritance taxes are sometimes also increased, though these typically raise very little money because so much wealth is illiquid that it is practically, difficult to collect on, and forcing the taxpayer to sell liquid assets to make their tax payments undermines capital formation. Regardless, transfers rarely occur in amounts that contribute meaningfully to the deleveraging (unless there are “revolutions” and huge amounts of property are nationalized).

最近美国对收入税的调整,以及打算对富人征税都是反映了以上的观点